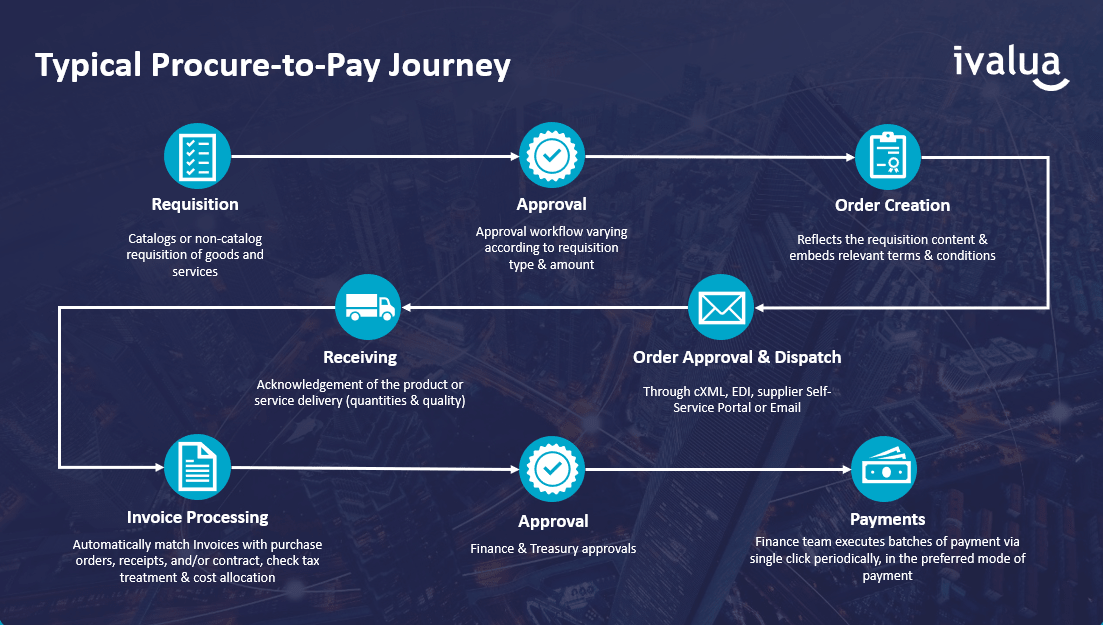

A guide to the purchase-to-pay process

The Purchase-to-Pay process enables CPOs and CFOs to manage the entire cross functional Procurement process and can offer valuable insight on Sourcing and Category Management on how about how people buy off the categories they have negotiated and how suppliers get compensated for their work. Data is beyond critical to purchasing and accounts payable teams. It is everything, and the burden falls on Procurement leaders to capture pertinent data to build good teams, track supplier performance and show value. With Digital Purchasing as a long standing mandate and now with the current pandemic the need to show value rapidly, Procurement officers must find ways to measure their progress towards Best-in-Class performance.

Here is a look at some of the Procure-to-Pay best practice tips Procurement leaders should focus on in order to better understand their digital purchasing progress. Use these tips and tools to measure and benchmark your P2P cycle against top performers:

#1 Use Purchase-to-Pay automation for touchless processing

“Touchless” means data is electronic, transactions match the first time and need no human intervention. This metric closely aligns with digital transformation progress. Fully automated, touchless purchase-to-pay processes lead to better PO compliance, invoice automation and invoice-less processing, high first-time-match rates and more payments-on-time. This metric also impacts others like speed, visibility, and cost savings. This is a key metric to measure efficiency and effectiveness of the procure-to-pay process.

#2 Focus on Supplier Management

How many suppliers you have for different spend management categories reflects your overall procurement health. Too many suppliers in one category may mean it’s time to simplify or negotiate better pricing with fewer vendors. On the other hand, relying on a limited number of suppliers introduces supply chain risk. Sourcing tools can help build the right plan to begin to right-size the number of suppliers.

#3 Look at On-Time Payment

Paying invoices on time is another indicator of a healthy purchase-to-pay cycle and is the hallmark of a streamlined Accounts Payable Automation. The ability to pay on time suggests procurement has negotiated good terms for the business and that Accounts payable runs its part of the payment process efficiently. It could also indicate your digital purchasing workflow is functioning as it should. Success in this metric also contributes to long-term supplier relationship management.

#4 Take note of Purchase Order First-Time Match Rate

If invoices match with purchase orders as they’re supposed to, all signs point to a compliant, efficient operation. A high first-time match rate requires that internal buyers and external suppliers follow your process requirements, so measure how many invoices go straight through the AP process on the first pass, without delay or manual intervention. Whether its 2, 3 or 4 way matching that’s required, the failure to match the first time causes an exception that must be addressed by someone in AP, or your supplier directly if you’re lucky to have some self-service capabilities for suppliers.

#5 Ensure Supplier Data Visibility

Data and analytics are critical in order to have meaningful information for business decisions. Without a full view to spend and supplier, at the line item level, sourcing organizations limit their reach and impact. Much of the spend management data needed for upstream activities comes from Procure to Pay transactions so make sure your process is capturing the right information in a usable format and preferably in the same system as you’re analyzing your spend to make things easier.

#6 Watch Number of Days to Approve an Invoice

If an invoice isn’t approved on schedule, you may miss out on discounts, so this is an important metric. Invoices that are pre-approved with POs save time, but if your PO compliance is under 50%, you must depend on your organization’s speed to approve an invoice, pay early and take a discount. A rules-based digital purchasing workflow helps improve this metric, accelerate the process and capture discounts, not to mention keeping suppliers happy.

Procurement metrics don’t have to be overwhelming, and neither does P2P cycle digital transformation. Watch the webinar replay from The Hackett Group and Ivalua they break down best practices and metrics.You can also download the Hackett Group Procurement benchmark report here to get all the relevant metrics to allow you to compare your performance against peers or top performers.

We covered these and more in this Webinar with The Hackett Group – “Closing the Gap on Procure to Pay (P2P) Digital Transformation“.

If you are interested in knowing more about the Ivalua’s Purchase-to-Pay Solution, please visit our procure-to-pay page or request a demo of our Procure to Pay software.

Embarking on a procure-to-pay overhaul? Download our complete procure-to-pay transformation checklist.