What is Invoice to Pay?

Invoice to Pay the process of receiving and then paying a supplier invoice. However, it is easy to forget that an Invoice is simply a payment request, and therefore it’s the job of technology to make this easy, fast and more efficient – for the Supplier and the Accounts Payable team.

All too often, Invoice to Pay is seen as an isolated process, sitting on its own at the end of a procurement journey. This activity starts with a need, moves through selecting a supplier, contracting and/or ordering the items, then the goods or services are received, before finally an invoice is sent by the supplier.

At each step of this journey, evidence is gathered that ensures that when the Invoice arrives, the AP can validate it for payment. Therefore, by using the supplier’s desire for payment, and good quality data, top performing organizations can achieve high levels of straight-through-processing and automation.

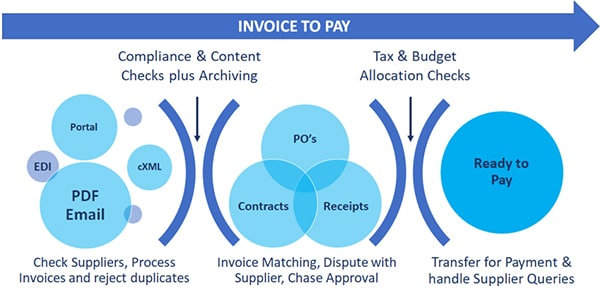

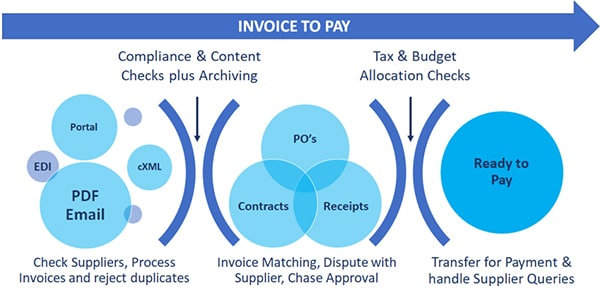

Invoice-to-Pay is therefore an integral part of the whole procurement process, and typically includes the following tasks:

Rather than the traditional silo’s of Invoice processing, budget allocation and payments, ensuring AP is not an isolated process but part of the whole procurement journey is important. This is because at each step; data is gathered, suppliers are onboarded, and deliveries are accepted.

If this is done in a coordinated way, Invoice to Pay is more powerful. The result of bringing these three steps together with data from the whole procurement journey is a seamless and almost touchless workflow that transforms accounts payable. This makes paying an invoice faster, simpler, and on time.

To learn more about the value of Invoice to Pay, download our white paper.

What Are The Benefits of Invoice to Pay?

A recent Hackett report identified that top-performing organisations, with high levels of AP automation, could save up to 54% on invoice processing costs and only had a third of the internal employees focused on AP. But there are more savings possible with self-service tools for the supplier that can save up to 50% on master data management costs.

By transforming the accounts payable process businesses can deliver indisputable value in the form of reduced transaction costs, traceability, and increased control over their payables timing. However, top-performing organisations did not only focus on eInvoicing or invoice management, they took a multifaceted approach.

This included centralized invoice receipt, digitization of all transactions, and the optimization of a single Invoice to Pay journey across the whole organization. For example, Invoice to Pay has enabled Select Medical to achieve 96% straight-through-processing of payment requests.

What Are The Barriers To Invoice to Pay Adoption?

Before looking at the Invoice to Pay journey, it is important to identify the barriers to achieving top performance. For this, another leading analysts’ group, Gartner has identified that Accounts Payable team must overcome a number of challenges with their Invoice to Pay solution. These fell broadly into three main areas:

- Suppliers have vastly different capabilities when it comes to generating invoices that support AP automation. This variability creates higher processing expenses, disconnected journeys, and lower straight-through processing rates.

- Invoice automation projects frequently only address document digitization, whilst it is the matching issues that introduce higher costs. This incomplete scope reduces the potential ROI and reintroduces problems that would be caught by manual invoice processing.

- Organizations cannot improve invoice match rates when there is no visibility into the root causes of match failures. As a result, process improvement and error elimination cannot occur without visibility and correction.

Challenge 1: How To Enable Supplier Adoption?

When organisations like Maxim Healthcare were only able to get 15 suppliers automated in 7 years, nothing downstream can be performance tuned. This is because the Accounts Payable teams have been expecting eInvoicing Networks to address this challenge.

Unfortunately, these Networks have now become the barrier to adoption by forcing new T&Cs and processes on the Supplier. However, while AP has been waiting for the promise made by eInvoicing Networks to come true, suppliers have evolved.

Today, everyone from the poolman to the global catalogue provider can email a PDF Invoice. Other suppliers have been forced to go eInvoicing, not by customers but by their own Governments via Clearance Networks. The solution is the Invoice Hub from Ivalua.

A solution that unlike eInvoicing Networks, is embedded within the Invoice to Pay journey thereby removing the barrier to supplier adoption.

To learn more about the amazing capabilities of the Invoice Hub, download the Invoice Hub datasheet.

Challenge 2: How To Truly Automate AP?

For most businesses increasing invoice processing efficiency to 70% across 60,000 suppliers would be a stretch target. However, this level of automation is what Credit Agricole has achieved with AP Automation for Ivalua.

They have unlocked the power of AP and hit amazing levels of straight-through-processing by utilizing smart matching within one-click workflows that manage line level allocations and tax treatment automatically. By removing the overhead of payment queries with real-time Supplier updates the AP team can focus on innovation and real exceptions.

The key to these performance levels is the embedded smart matching that uses supplier master data, orders, receipts, even contracts to automate the flow. Exceptions can then be handled with one-click approval for invoices, or by simply appending the missing PO number, to complete the auto-match.

With line level multi-tax treatment and budget allocation templates that reduce effort AP automation rates can reach way above 70%.

However, the real power of Invoice to Pay from Ivalua is that all this matching is also available within Supplier Self-service linked to the Invoice Hub. That is true innovation and a level of digital transformation just not possible in an eInvoice Network.

Now selected suppliers can upload a PDF invoice in the free portal, check all the content is correct, append that missing PO or tag the buyer, before matching the invoice to the receipt or order. Only once all the invoice meets the tolerance policy for automation will it be accepted.

The supplier can now elect to send in a disputed invoice or load a new invoice that matches, either way the payment clock only starts when the invoice is cleared for a straight through journey.

To learn how to truly Automate Accounts Payable, download our datasheet.

Challenge 3: How To Continuously Tune and Improve?

Having the ability to continuously improve (CI) a process is critical to achieving a return on investment and should be at the heart of all cloud technology. Without this, organizations cannot be agile and without analytical data, continuous change is impossible.

This is why Ivalua provides the dashboard and performance intelligence necessary to evolve, adapt and improve the Invoice to Pay journey as standard. Unlike eInvoicing Networks, or prescriptive services you are in total control of your Invoice to Pay journey.

Once you have our quick start journey in place, the AP team can create new templates and processing rules, the workflow can be extended or adapted without breaking the system.

Learn more about the power of CI in Credit Agricole.

Invoice to Pay from Ivalua

Ivalua has been recognized as best-in-breed across the Source to Pay by the leading analysts, so once you have this level of advanced accounts payable automation, your focus can switch to adding capabilities that are designed to deliver additional value, such as mitigating invoice fraud and compliance, plus increasing working capital value from the financial supply chain – welcome to Ivalua Invoice-to-Pay.

Understand more about our Invoice to Pay solution by reading our datasheet.

How does Invoice to Pay Work?

To jump from just invoice processing to becoming a top performer requires a break from analog thinking. AP teams need to embrace digital data and think end-to-end. This is because controlling the flow of invoices into the Accounts Payable team has become increasingly complex to manage.

In part, this is due to the challenge of handling high volumes of supplier invoices being merged with the new digital Government Networks. The solution is to follow the top performers and focus on supplier enablement, smart matching and introduce the agile methodology of continuous improvement.

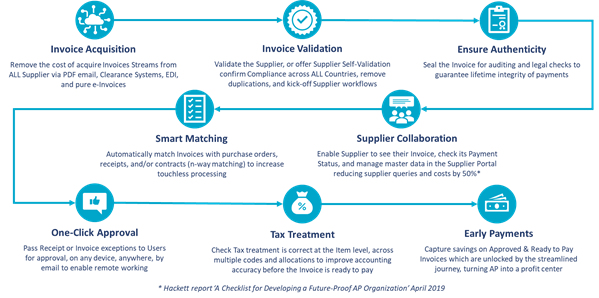

Gartner calls this level of automation ‘Advanced Accounts Payable Invoice Automation’ or APIA and we have built our solution around this concept while maintaining our plug and play approach to support our customer needs by offering modules to support each area of the journey. However, we have built an of out-of-the-box workflow which support the whole APIA methodology:

Our Invoice to Pay journey starts with the invoice being acquired from the supplier, in whatever format they can send, from an easy PDF email, to a fully electronic invoice. The moment the invoice arrives in the Invoice Hub, Ivalua will check the supplier and validate its content is tax compliant before further processing.

At this point our advanced workflow even allows you to set self-validation rules for suppliers. This unique capability helps the supplier check their invoice content from email, an uploaded copy, or one created in the portal. Once validated our embedded AI engine will automatically match the invoice to a contract, purchase order, or receipt before confirming tax treatment and budget allocations.

If at any stage buyer interaction is required, this is provided via a low touch email or mobile friendly interface. To reduce the impact of Supplier inquiries, they have visibility of the invoice status and can even mitigate issues before they become a costly dispute.

If any invoice is found wanting, it will be parked or rejected. If the supplier is unknown a new vendor workflow can be started, and the supplier is given a free self-service portal account – without a third-party network getting in the way.

Invoice to Pay from Ivalua transforms the accounts payable process and can deliver indisputable value in the form of reduced transaction costs, traceability, and increased control over payment timing.

This is supported by data from The Hackett Group’s most recent Purchase-to-Pay Performance Study that flags organisations with high levels of AP automation as saving 54% on invoice processing costs and have a third fewer internal employees processing Invoices.

To learn more about Invoice to Pay from Ivalua ask for a no obligation demo today ask for a demo.