|

The Forrester Wave™: Supplier Value Management Platforms, Q3 2024 See Report

Blog »

How to Stay Agile as Regulation Looms: Outsourcing, PRA & the Role of Procurement

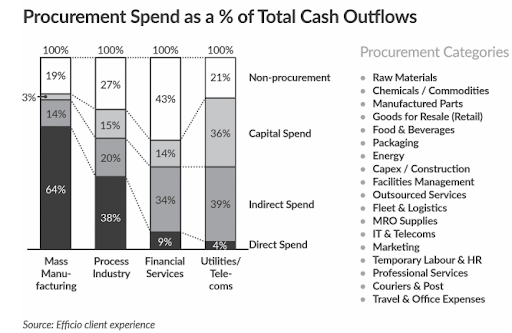

It may be a controversial statement to make, but the value that a procurement team can deliver within a financial services organisation is lower than what can be delivered in other sectors. The third party spend of a financial services organisation, as shown by this diagram is significantly lower, when compared to other sectors such as manufacturing. A CPO in a bank does not have the same opportunities to work with stakeholders across the business, such as Rolls Royce, one of Ivalua’s customers, where the direct spend directly impacts the performance of the business as a whole and the level of direct spend is much higher.

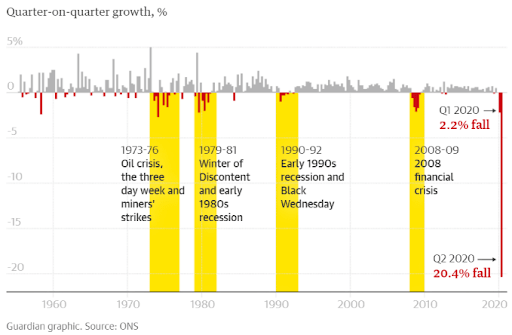

Another characteristic of the financial services industry is the high level of compliance due to the importance of the financial services sector to the global economy as a whole. Recent research states that the current covid crisis has had a much larger impact in the UK compared to the financial crisis of 2008/9, but it should be recognised that the financial services sector has greater regulatory scrutiny.

A CPO at a bank or other type of organisation within the financial services sector must recognise the potential for leveraging the supplier compliance issue to enable the procurement team to deliver greater value to the business.

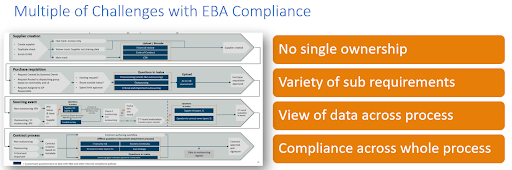

Over the past 18-24 months Ivalua has heard from several financial services organisations trying to understand how technology can meet the challenge around third party outsourcing agreements defined by the European Banking Authority (‘EBA’). There are many articles available on the scope and applicability of these regulations, but in summary it means that a financial services organisation needs to identify if a new or amended agreement for a service involves outsourcing and if so, there are a number of steps that need to be taken through the contracting process.

There are several challenges for a financial services organisation to deliver compliance in this area.

- Compliance is spread across the whole contracting process. This means that an organisation needs to ensure a compliant process for the initial request for an agreement involving outsourcing, sourcing activities, contract creation/amendment, supplier management, etc.

- Unlike other regulations, such as OFAC there is no single user community that can own the regulations and this means the risk function within the organisation cannot make one user community accountable for the regulations.

Due to the number of outsourcing contracts being used by financial services organisations, attempting to address this issue through a manual process is going to be problematic. Some FS organisations are trying to meet these regulations with an approach of retrospectively applying compliance to the agreements, recognising that this is not a long term solution. Others have explained that they are relying on multiple systems to meet the regulations, but this also requires a high degree of manual work. Lastly, some are having to take a manual approach to meet the regulations, utilising and maintaining spreadsheets to capture information.

As with most challenges within organisations, technology cannot be the sole answer to meet this challenge, but Ivalua believes that it can be part of the solution.

A large bank in the Nordics region has recently implemented Ivalua to meet the needs of the EBA regulation and deliver procurement transformation to enhance the capabilities of the procurement function. The approach to ensuring compliance for an outsourcing agreement with Ivalua is to ‘bake in’ the requirements and checks at each stage of the process.

Sensing that this was a challenge for financial services sector organisations across Europe Ivalua has developed capabilities to address EBA regulations. The Ivalua solution will apply the right checks and processes to enable compliance to EBA regulations and due to Ivalua’s flexibility, future changes to the regulations can easily be accommodated.

Financial services procurement leaders can turn this challenging scenario into an opportunity to add value to the business. By taking ownership of this critical compliance and offering a solution, CPOs can truly empower procurement to generate strategic value. Value within the business from meeting regulations and cost savings can be combined to deliver the type of business case that justifies investment in enhancing the procurement function of a financial services organisation.

The UK has a large financial services sector and due to Brexit the EBA regulations are not applicable. However, there are the Prudential Regulatory Authority (PRA) defined regulations in the UK. The PRA has recently concluded a consultation in this area and announced that similar regulations will be applied on 31st 2022.

Ivalua held a roundtable session along with CIPS’ Supply Management magazine to get some feedback from UK FS organisations in this area. The feedback from the group was that they are still trying to fully understand how the regulations need to be executed within their organisations. A central challenge seemed to be that the regulations were not as prescriptive as anticipated and some interpretation was required. This may create issues when building processes to meet the regulations. There was also some interesting discussion around future regulatory challenges that can be seen on the horizon, such as DORA, which it was assumed will impact how financial services organisations interact with cloud service providers.

The roundtable was principally to understand the readiness of the UK market to meet the regulations, but there was some discussion around the group’s view of utilising technology to deliver compliance to the regulations. It is fair to say that there was a large amount of scepticism in the group that it is possible for a software vendor to deliver a solution that ‘bakes in’ compliance as agreements pass through the supplier/sourcing/contract stages.

The scepticism is understandable as the reason why Ivalua can deliver in this area where other solution vendors may struggle is down to two key areas of differentiation. Firstly, Ivalua is a platform that covers the full source to pay process, using a single data set, code base, workflow engine and user interface. This means that the whole process can be covered with complete visibility of a transaction. For instance, a new contract request is captured and is immediately available to the sourcing and contract teams when they are engaging with the supplier. Secondly, the flexibility of the Ivalua solution allows for the compliance steps to be configured into the solution and driven by the sophisticated workflow engine. As this is achieved through configuration rather than coding, future regulation changes can be easily accommodated by reconfiguration.

The roundtable format of the event meant that a demonstration was not possible and we had to politely agree to disagree, but we did promise to spend some time showing some of the participants what we have to offer, as we welcome feedback from the sector.

This offer will also be opened up to the wider financial services community as we will host a webinar to explain what we have in this area and finally get to demonstrate how we feel technology can be part of the solution to the compliance challenge.

Register for the webinar today.

Stephen Cleminson

Alliances Director

Stephen Cleminson is the Alliances Director at Ivalua. He’s responsible for recruiting and managing a partner network across Northern Europe and brings experience of over a decade in commercial roles at a number of P2P vendors. Stephen has built a comprehensive understanding of the benefits and challenges of P2P technology from his close involvement in a variety of projects for large multi-national organisations.

Stephen’s experience was initially in the use of P2P solutions for indirect spend, but Ivalua’s strengths in direct materials procurement has expanded his knowledge and expertise to this important operational area.