Blog »

What is e Procurement?

What is e Procurement? e Procurement Definition:

E procurement or e-procurement comes from electronic procurement. It relates to the digitization of the Procure-to-Pay process through specialized tools. Cloud-based procure-to-pay solutions are a must-have for any company that wants to have a best-class P2P Process.

Benefits of an e Procurement Software

e Procurement brings many benefits to any enterprise which deploys a software solution:

–Maximized compliance with corporate policies and growing legislation requirements with little effort. Rules and workflow engines automate this part for you.

–Spend control through real-time visibility into budget consumption, negotiated prices, preferred suppliers, engagement channels. Alerts inform you of any deviation which allows you to set up mitigation plans and follow up on corrective actions. Also, e procurement software provides you with clean spend data, which is the basis for a sound spend analysis and eventually relevant category management.

–Process efficiency with reduced cycle times and considerably decreased errors or fraud opportunities

–Cost optimization which comes from two sources: first, the savings that are captured from purchasing through preferred suppliers and compliant channels, and second the lower cost of a more efficient purchasing process. The latter is a hidden cost which is often forgotten. Think about all the users (requisitioners, approvers) of a P2P process and the amount of time they spend purchasing if the process is inefficient. All this valuable time is paid back in increased productivity for the business once e procurement software is deployed.

-Boosted stakeholder satisfaction. Users only see information that is relevant to them, i.e. Requisitioners see expected delivery dates, Managers their budget consumption, Accounts Payable their pending invoices. Users do not have to memorize all the rules and business cases they need to go through: the e procurement software embeds all the rules and softly guides the user into compliant purchasing.

–Enhanced collaboration as the software allows Procurement, stakeholders and suppliers to exchange information quickly, but also to work jointly on certain item. For instance, purchase orders could be directly amended by a supplier to reflect his stock or delivery capacity. Also, receipt could be better prepared by considering supplier’s Advanced Shipping Notices (ASN).

Obviously, not all the Procure-to-Pay solutions of the market offer the same value, that is why choosing the right one is critical.

Criteria to Choose the Right e Procurement Software

–All spend must be supported, whether direct materials or indirect spend, products or services, CAPEX or OPEX so that users can purchase all they need. It is key to avoid maverick spend.

–Guided-buying capabilities allowing your users to be softly routed to compliant buying channels through a shopping-like user experience. This is important to maximize the adoption of the tool and eventually of the process.

–All process steps must be supported to make sure automation is efficient, especially those steps which usually happen offline, via email or phone. A typical example is purchase order (PO) updates. As suppliers cannot modify POs, they inform their customer by email that they must change an item, a price or a delivery date of the order. The user forgets to reflect these changes in the PO and eventually, when the invoice comes in, it does not match the initial PO which has not been updated. Therefore, allowing suppliers to update (under the user control) a PO is key.

–Integration to other systems like ERPs or MRPs to connect to other stakeholders’ data, but also be able to connect to third party data providers to enrich your Procure-to-Pay process. For example, you could check the sustainability score of a supplier through Ecovadis before ordering a certain product.

–Flexibility to deploy quickly without compromising your ability to evolve with ever-changing regulation, new corporate policies or your growing organization without waiting for the next software release.

Selecting the right Procure to Pay software will preserve you from failed deployments. Now, you need to build your business case to get that budget from Finance.

Building the Business Case for e Procurement:

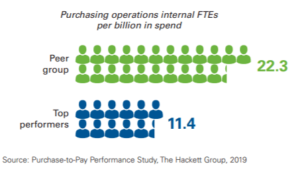

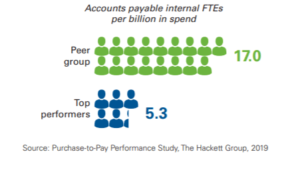

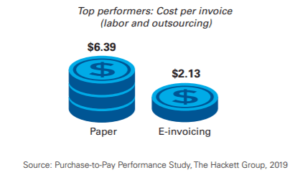

Your business case comes down to one question: what Return On Investment (ROI) should I expect? As we have seen earlier, there are two sources of benefits: increased savings from more compliant purchasing and process cost reduction. On the latter, a report from The Hackett Group gives us some benchmark about how much return can be achieved:

-Divide by 2 the Purchasing operations internal FTEs

-Divide by more than 3 the Accounts payable internal FTEs

-Divide by 3 the cost per invoice:

Our customers achieved impressive results shortly after deploying our Procure to Pay solution.

Customer cases:

Case Study #1: Leading Information Services provider

-Pain-Point: Poor purchasing compliance and fraud control

-Challenge: Integrate to a broad range of legacy solutions

-Benefits:

- 95% compliance by reducing maverick buys

- 95% of automatic invoice reconciliation

- Suppression of overpayment

- Reduced fraud opportunities

Case Study #2: Leading Financial Services and Mortgage provider

–Pain-Point: Inefficient Procure-to-Pay process

–Challenge: Simplify P2P process with massive user (1000+) & supplier (70,000) volumes (

–Results:

- 30% decrease of process time

- 100% of electronic POs

- Increased user & supplier satisfaction

- Freed resource capacity for strategic procurement