The Complete Guide to a Best-in-Class Procure-to-Pay Process

by Arnaud Malardé

Everything you need to know about optimizing your Procure-to-Pay Process

What is Procure-to-Pay (P2P)?

To put it simply, Procure-to-Pay is a standardized business process that allows a business to efficiently buy goods and services from their suppliers and pay them. The process typically contains five steps (purchase requisition, purchase order, receipt, invoice and payment) and several related approval workflows. Procure-to-Pay is the downstream part of a larger process, Source-to-Pay. This upstream process comprises spend analysis, sourcing, selection, contracting and overall supplier information, risk and performance management. If Source-to-Contract answers the question “which supplier should I do business with?”, Procure-to-Pay responses to “how should I engage with that supplier and buy from that contract?”.

What is the Objective of a Procure-to-Pay Process?

Procure-to-pay is primarily meant to introduce a streamlined and efficient process, prevent employees from buying from non-contracted suppliers and finally protect a company from liabilities by ensuring that any transaction is supported by a budget and a legal framework that is compliant with internal policies and regulation. But it provides better visibility and structure to ensure that any purchased product or service is delivered on time and according to the agreed price and quality before payment is made to the supplier.

Why is Procure-to-Pay Important?

Procure-to-Pay is increasingly an essential business process to automate in order to effectively capture the value that has been created in upstream processes. It serves as a way to standardize the P2P process across an organization, improving overall efficiency, visibility and reducing the cost of the process while putting in place the appropriate controls (e.g., available budget, internal policies, compliance to regulations, etc). In many organizations, often the person who purchases or creates a purchase requisition for a product or a service is typically not the person who owns the budget or the person who is eventually paying a supplier for this product or service. Therefore, a digital business process with varying levels of control is made possible through an automated procure-to-pay process. This ensures every stakeholder agrees and approves, in a seamless and efficient manner, the transaction prior to the money being spent.

What are the Main Challenges with Procure-to-Pay?

Typically, the main P2P Procurement challenges are related to inefficiency, lost savings, visibility into spend and a high processing cost. The procure-to-pay process involves several stakeholders, all with varying roles and expectations:

- A requester who quickly needs goods or services to do their job effectively

- A supplier who offers a product or a service and wants to be paid fast once delivery is complete

- Procurement who wants its preferred suppliers to be used to realize savings

- Budget owners who want to manage their budget consumption

- Accounts Payable who must validate invoices before paying them on time

- Legal who avoids any risk and wants to maximize compliance

The challenge of the P2P process is to reconcile all these stakeholders’ needs and ensure they collaborate efficiently so that control does not impair the spend of business. When this process is conducted manually or with inefficient tools, time and information are lost. As a result, controls are satisfactory and business expectations are not met.

Here are some symptoms of a poor procure-to-pay process. While there are many, they usually come down to four categories:

- Non-compliance: Involves spend potentially not going to preferred suppliers, retroactive orders to cover invoices received or payments made without internal approval or appropriate budget checks.

- Frequent errors: Incorrect supplier information, wrong purchase orders, varying pricing or volume amounts between purchase order and invoice, missing delivery documentation or duplicate payments.

- Resource-intensive: Purchasing operations or accounts payable teams flooded with lots of new supplier creations or late invoices stacks or approvers being overwhelmed by approval requests

- Poor user experience: Overall, a poor user experience due to tedious tasks that must be completed to buy something or process an invoice, inability to find what a user is looking for in a simple, quick manner. The P2P process is seen as a barrier rather than enabler.

The above are some symptoms of an inefficient and ineffective P2P process. Measuring how well (or bad) a Procure-to-Pay process is doing requires Key Performance Indicators (KPIs).

Key metrics of Procure-to-Pay process:

Although Procure-to-Pay KPIs can slightly vary from one company to another, these 10 metrics are the most common ones and a good baseline to start with.

- Compliance: Percentage of invoices that are linked to a compliant engagement channel, e.g, purchase order procedure, contract, purchasing card…

- Post-Commitment: Percentage of purchase orders that are created after an invoice is received

- Post-Receiving: Percentage of receipts that are created after an invoice is received

- Purchase Requisition to Purchase Order Lead Time: Average number of days to transform a requisition into an order going through an approval process

- Number of Purchase Orders per Full-Time Equivalent (FTE): A measure of efficiency

- Invoices Paid on Time: Percentage of invoices paid within the agreed terms or legal deadline

- Days Payable Outstanding: Average number of days it takes a company to pay back its accounts payable.

- Number of Invoices per Full-Time Equivalent (FTE): A measure of efficiency

- Supplier Database Growth: Percentage of new suppliers added to the data base on a year to date basis

- Active Suppliers: Percentage of active suppliers in the supplier database, meaning suppliers with at least one transaction on a year to date basis

An effective way of improving the overall Procure-to-Pay process and the metrics is to adopt an Procure-to-Pay solution.

Difference between Procure-to-Pay and eprocurement

Procure-to-Pay is the sequential process we described earlier. Eprocurement or e-procurement comes from electronic procurement. It relates to the digitization of this process through specialized tools. Cloud-based Purchase Order Software is a must-have for any company that wants to become best-class in P2P Procurement.

Benefits of a Procure-to-Pay Solution

A Procure-to-pay software solution unlocks a tremendous amount of value for any organization. Some of the benefits are:

- Capturing more savings: With more compliant buying channels, more spend with preferred and contracted suppliers, an efficient and automated process, higher user satisfaction and productivity, a P2P solution will enable higher savings to be captured and realized.

- Improve Compliance: Compliance towards corporate policies and also growing legislation requirements around tax and with little effort. Rules and workflow engines automate the entire business process and make it easier for all involved to make better, faster decisions.

- Spend visibility and control: Through real-time visibility into budget consumption, negotiated prices, preferred suppliers, engagement (buying) channels, invoices and more procurement has more visibility and control over spend. Depending on the solution, Procurement can get tremendous insights into buying patterns, category strategies, supplier negotiations, etc. Also, a procure-to-pay solution provides you with clean spend data based on invoices and payments, which is the basis for a sound spend analysis and eventually relevant category management.

- Process efficiency: Drastically reduced cycle times and considerably decreased errors or fraud opportunities, ultimately leading to lower processing costs allowing for teams to focus on more strategic activities.

- Boosted user satisfaction: Enabling an intuitive and modern user experience that saves time and provides a positive experience is high priority for a procure-to-pay solution. Adoption for both users and suppliers is a core part of the ROI and value proposition for a P2P solution and user experience drives adoption. Modern Procure-to-Pay solutions offer users guidance throughout the process of buying and relevant business rules and workflows for processing transactions.

- Enhanced collaboration: P2P solutions bring together all those stakeholders – users, procurement, managers, accounts payable, suppliers, etc and allow them to effectively collaborate. For instance, purchase orders could be directly amended by a supplier to reflect his stock or delivery capacity. Also, receipt could be better prepared by considering the supplier’s Advanced Shipping Notices (ASN).

Obviously, not all the Procure-to-Pay solutions offer the same capabilities or value proposition, that is why choosing the right one for your business is critical.

What to Look for In a Procure-to-Pay Solution

- All spend must be supported, whether direct materials or indirect spend, products or services, CAPEX or OPEX so that users can purchase all they need. It is key to avoid maverick spend.

- Guided-buying capabilities allowing your users to be softly routed to compliant buying channels through a shopping-like user experience. This is important to maximize the adoption of the tool and eventually of the process.

- All process steps must be supported to make sure automation is efficient, especially those steps which usually happen offline, via email or phone. A typical example is the purchase order process and purchase order updates. As suppliers cannot modify purchase orders, they inform their customer by email that they must change an item, a price or a delivery date of the order. The user forgets to reflect these changes in the PO and eventually, when the invoice comes in, it does not match the initial PO which has not been updated. Therefore, allowing suppliers to update (under the user control) a PO is key.

- Integration to other systems like ERPs or MRPs to connect to other stakeholders’ data, but also be able to connect to third party data providers to enrich your Procure-to-Pay process.

- Supplier Information is key to a smooth P2P process, ensuring that some level of supplier information (if not complete supplier master data) is maintained and kept up to date is key to efficiency and seamless matching.

- Flexibility to get up and running quickly with a solution but also not be limited by the technology when your business needs to evolve or adapt processes to meet ever-changing business conditions (e.g., regulation, new corporate policies, M&A, etc)

Selecting the right Procure-to-Pay software is one thing but first you need to build your business case to get that budget from Finance

Building the business case for Procure-to-Pay Software Automation:

Your business case comes down to one question – What Return On Investment (ROI) should I expect? As we have seen earlier, there are two sources of hard benefits: increased savings from more compliant purchasing and process cost reduction, with additional soft benefits.

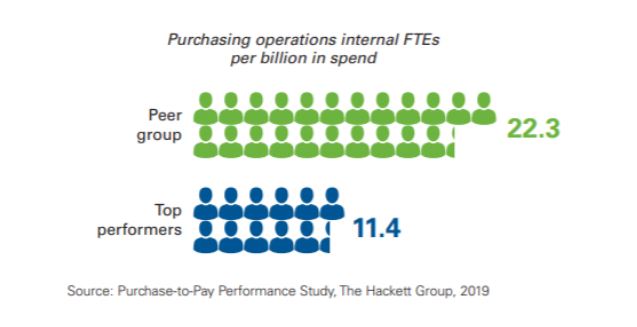

On the latter, a report from The Hackett Group gives us some benchmark about where improvements can be made and ultimately the potential for the business case:

1. Significantly higher purchasing operations efficiency:

2. Huge improvements in Accounts Payable efficiency:

3. Ultimately a much lower cost per invoice:

Ivalua was recently recognized as a leader in the Gartner Magic Quadrant for Procure-to-Pay Suites 2020. If you are interested in knowing more about the Ivalua’s Procure-to-Pay solution, please visit our Procure-to-Pay page or request a demo of our Procure to Pay software.